When choosing a payment method, a user should consider various factors, such as convenience, fees, transaction speed, and others. Safety is also a highly important matter to keep in mind. If you are going to use Pleo, learn how secure this payment method is.

What Is Pleo?

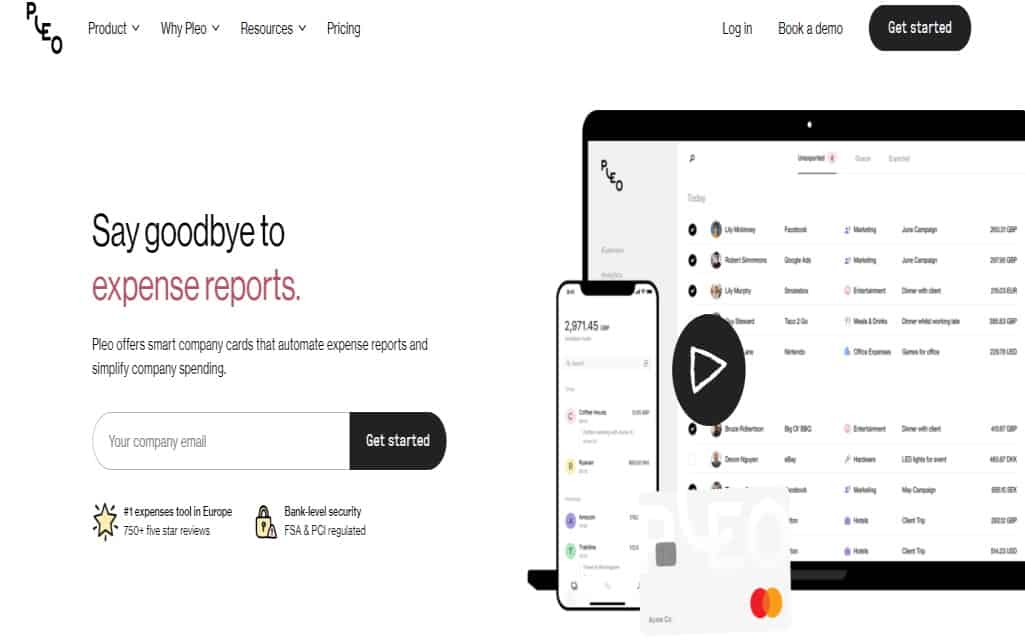

Pleo offers cards for your business. The company was founded in 2015 by fintech experts. Currently, it has over 200 employees and serves over 15,000 clients.

Employees can purchase things that they need while admins get instant information about any transaction. That is a great tool to keep control over corporate finances.

Such cards are issued in two forms, including:

- Virtual;

- Plastic.

Virtual cards can be obtained right after signing up for services. After downloading the Pleo application, users can log in and access all the details about their balances and transactions.

The cards are suitable for making online purchases and buying products/services on a subscription basis. Right after signing up for the Pleo services, the physical card will also be ordered for you.

How Is Security of Pleo Ensured?

The company has been around for more than six years. It is certified with the PCI DSS which makes it a fully safe payment solution. Also, the company regularly performs penetration tests to find any possible vulnerability. Additionally, Pleo has a variety of tools to prevent any fraudulent behavior.

All purchases via Pleo are tracked instantly. It is possible to block a card in case of suspecting its unauthorized use. No one has direct access to your money because it is sent via one of the authorized banks such as Danske Bank.

Conclusion

Pleo is a fully secure service that can help businesses effectively manage and control their expenses. It uses a variety of security measures and has proper safety certifications. This means that this solution can be utilized with peace of mind.