Mobile devices are taking over the market, and every fourth user spends seven hours with a smartphone in hand. Mobile banking app development updates your business and makes it more flexible. Nowadays it’s impossible to imagine the life of a person, who has to spend long hours, waiting in the queue to get some kind of service. Mobile applications are able to deal with all the tasks, no matter how difficult they are, to save time and guarantee results for the users. And these applications have one more benefit. They are absolutely safe.

Which business needs a mobile app with integration

A mobile application with a database is useful for companies with a turnover of goods. You get everything in one place and you don’t have to process applications through the admin panel.

Mobile app development is a complex process that consists of six stages. Individual specialists work at each stage.

Market analysis and concept creation

At the beginning of the development of a mobile application – market analysis. Even if you only have an idea, we can make it happen. At this stage, “business neighbors” are studied, the target audience is determined and segmented. Clear requirements for TK are drawn up, including for the client’s database. After agreeing on the terms of reference, we begin product development.

Design

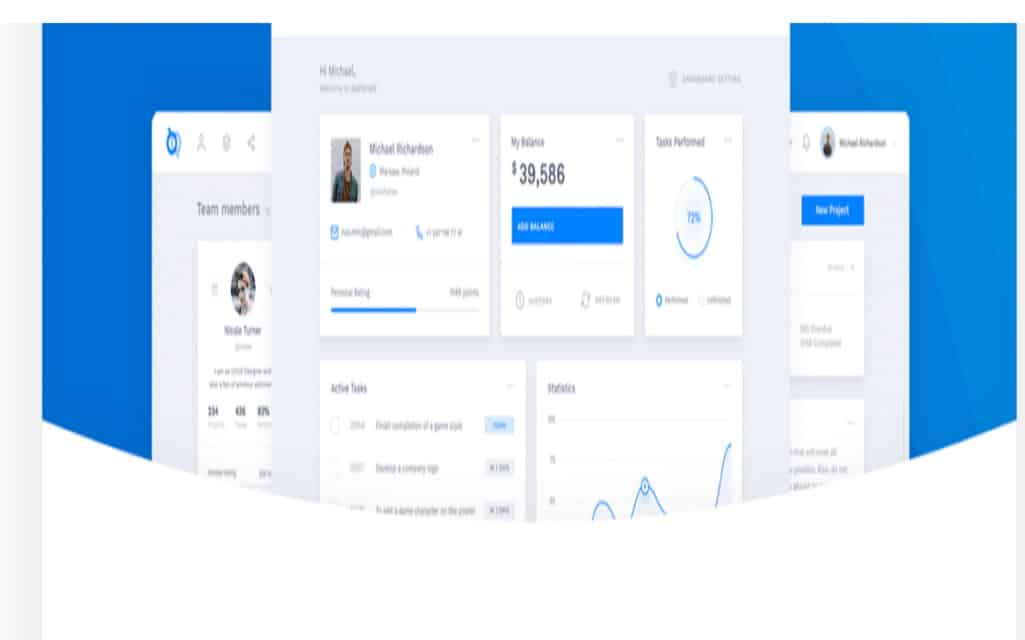

This is a difficult and crucial stage because it is on it that your product is born. Based on a thorough analysis, a UX specialist prescribes user portraits, determines the typical behavior of each avatar, and creates stories. The result of the work at this stage is a mock-up that is sent to the client for approval.

If the layout is approved, the designer starts to work. All icons, logos, animations, infographics are carefully drawn. The designer creates a unique style for your application. After the approval of the visual content in full cycle product development, the product is sent to the programmers.

Technical part

To write robust and working code, our developers turn to coding magic and powerful tools. At this stage, the admin panel is also structured, the logic is built, the layout is carried out.

Strategically, for many financial organizations, mobile banking still remains a tool for promptly signing payments. It views statements and account balances by the top officials of companies. While all basic operations are carried out in Internet banking by accountants. But this approach has become obsolete in recent years and has undergone significant changes. Today it has become clear that in order to increase ROI. Here is created additional cash flow from the commission and interest income. It is important not to be limited only to the role of CEO or director, not to bind clients only to the browser version. It provides access to mobile banking to company employees with different roles. It performs as much as possible more operations.

That is, mobile banking will increasingly become not a “light” application with a minimum of functions that complements Internet banking. But a full-fledged channel of access to all banking products, operations, and services with different roles. It is necessary to conduct all operational activities without being tied to an office. Here is used a smartphone or tablet.

There is also an IT architectural trend: a move away from the creation and maintenance of many narrow-profile mobile applications. For each of which here is required to form a separate development team or conclude an agreement with a separate vendor – for the All-in-one mobile application. In this case, we are talking about one development team or one vendor.