Kaunas, Lithuania (July 18, 2022) – the global digital identity verification and fraud prevention company, iDenfy, introduced a new feature to its automated ID verification toolkit, Face Authentication. The newly launched service will help authenticate existing customers by eliminating account takeover threats.

iDenfy explains that many businesses strive to design a seamless onboarding experience for their customers, making it as fast and easy to use as possible. A great example is the Fintech industry, which is booming and leaving traditional banking behind. Despite that, the identity verification company continues to argue that some enterprises concentrate on the speed factor and are tempted to weaken the security part of their identity verification process.

The Federal Trade Commission (FTC) reports that each year, fraudsters steal at least 9 million identities around the world. Once this data is breached, cybercriminals open many doors: from making purchases and wiring funds to selling the data on the Dark Web. According to iDenfy, mitigating identity fraud in the digital world isn’t an easy task, as there’s a constant threat of account takeover when performing high-value transactions or changing sensitive account data.

As specified by Domantas Ciulde, the CEO of iDenfy, such actions should be secured using additional verification methods but without the hassle of a complex multi-step procedure. To simplify the journey for the customers, iDenfy claims to have created a smart feature using the most reliable biometric authentication data – the face. Based on identity verification market research and the demand for user-friendly Know Your Customer (KYC) solutions, iDenfy designed a new facial recognition implementation.

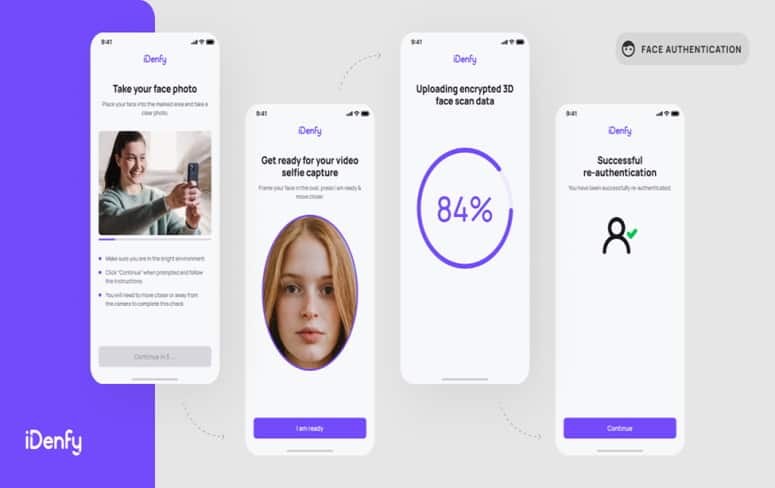

According to the enterprise, the customer completes the whole process in three simple steps. First, they need to go through the standard identity verification using their face. Then, the customer performs simple head movements. Lastly, after receiving the ID verification results, due to the new Face Authentication feature, the service will instantly tell whether the customer performing face authentication is the one who completed identity verification in the first place.

iDenfy’s goal is to prevent fraud and simplify identity verification, which led the company to create the Face Authentication feature. As said by iDenfy, the new service welcomes back the customers without them having to go through the full, lengthy identity verification process. As an illustration, iDenfy compares its new feature to a standard password or Two-Factor Authentication (2FA).

“Instead of passwords that are difficult to remember, customers can be onboarded easier using our new facial recognition technology. Our module can be integrated into any onboarding flow within a few hours. We also customize our solution to match brand guidelines and make it more familiar for the customers.” — explained Domantas Ciulde, the CEO of iDenfy.

About iDenfy

iDenfy, a platform of identity verification services and fraud prevention tools, ensures AML and KYC compliance for every company — from large-scale businesses to small organizations. The rapidly growing business was named the best “Fintech Startup” in 2020. The company also received recognition for winning a Baltic Assembly Prize for innovation in 2021.

For more information and business inquiries, please visit www.idenfy.com