In today’s rapidly evolving technological landscape, the role of bank cards in our daily lives has become increasingly significant. These plastic cards serve as convenient tools for conducting financial transactions, allowing individuals to make purchases, pay bills, and access funds with ease. With the advent of digitalization, the reliance on cash has diminished, as consumers embrace the convenience and security offered by electronic payments.

Despite the widespread use of bank cards, many individuals may not fully comprehend the detailed information encoded within the digits displayed on their cards. One such essential component is the Bank Identification Number (BIN), a unique numerical identifier assigned to each card. The Bank Identification Number (BIN) contains vital information crucial for identifying various aspects of a card, such as its type, issuing bank, country of issuance, and the corresponding ISO country code.

Why is it so important to understand the significance of BIN? There are several reasons to explain this. Firstly, BIN serves as a vital tool in combating fraud and unauthorized transactions. It aids in verifying the authenticity of the card and confirming its ownership by the designated cardholder, thus thwarting unauthorized transactions and safeguarding the interests of both customers and merchants.

Furthermore, BIN verification plays a pivotal role in authenticating card ownership, ensuring that transactions are conducted by authorized individuals. This authentication process adds an extra layer of security, mitigating the risk of fraudulent activities such as identity theft and unauthorized card usage.

In addition to fraud prevention, BIN verification is essential for regulatory compliance in certain industries, particularly in the realm of online payments and e-commerce. Following regulatory requirements and industry standards is imperative for businesses to avoid potential penalties and legal repercussions. By verifying BIN information, organizations can ensure compliance with relevant laws and regulations, thereby fostering trust and credibility among consumers.

Given the importance of BINs, numerous online platforms provide BIN verification services to cater to consumers’ needs. While an abundance of options exists, this article will focus on highlighting the top three BIN checker platforms renowned for their reliability, accuracy, and user-friendly interface.

Best free BIN checkers

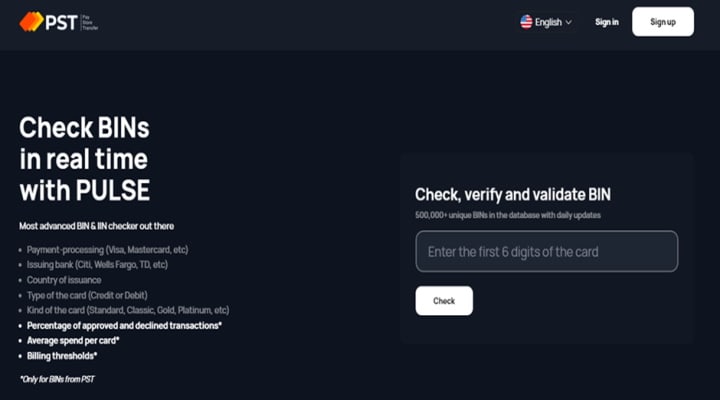

BIN CHECKER PSTNET PULSE

PSTNET offers a BIN checker with a vast database comprising over 500,000 constantly updated entries. This tool furnishes essential details including the card’s category, issuing bank, country of origin, and ISO country code.

Additionally, users of PSTNET enjoy access to an advanced BIN and IIN verification program, offering additional insights into their cards, including payment processing details (such as Visa or Mastercard), the issuing bank (such as Citi, Wells Fargo, TD, and others), the country of issuance, and the type of card (whether it’s a credit or debit card, and its specific type like Standard, Classic, Gold, or Platinum).

PSTNET also provides unique services tailored for its card users, such as:

· Percentage breakdown of approved and declined transactions

· Average spending per card

· Billing thresholds for managing expenses efficiently.

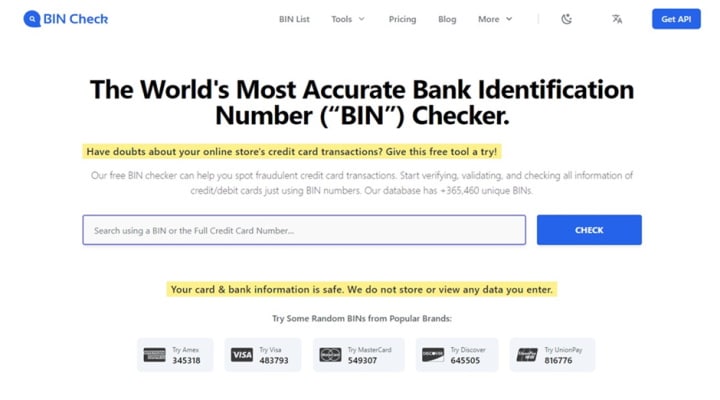

Bincheck.io

Bincheck.io earns its place as the second contender in our ranking. Serving as a credit/debit card BIN checker, Bincheck.io boasts a vast database comprising more than 356,000 unique BIN numbers. Furthermore, the platform extends its utility by providing users with several complimentary tools, including BIN verification, IP/BIN verification, and geolocation services.

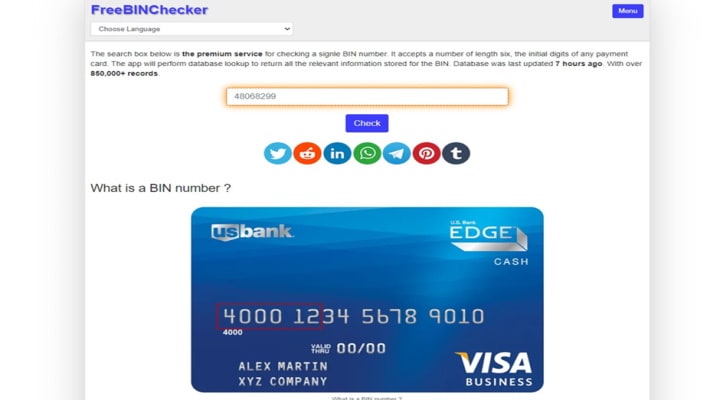

FreeBINChecker

The last service on our list is FreeBINChecker. This service boasts its unique benefits, including speedy request processing. Users can input a six-digit number, corresponding to the initial digits of any payment card, into the search box for a quick check. The application then conducts a database search to retrieve all pertinent information associated with the BIN.

In summary, whether you’re an individual seeking to authenticate your card or a business striving to bolster transaction security, these free online BIN checker platforms provide invaluable services. PULSE, Bincheck.io, and FreeBINChecker each present distinct features and advantages, catering to a range of needs. Utilizing these resources empowers you to protect both yourself and your business from deceptive practices, optimize the efficiency of payment processing, and ensure compliance with financial standards and regulations. It’s essential to remain vigilant and well-informed in the digital landscape to uphold your financial integrity.