Most of us claim to live a loan-free life and depend upon cash only.

The reality is a bit different from it; around 44.7 million people are borrowers of loan from different financial institutions.

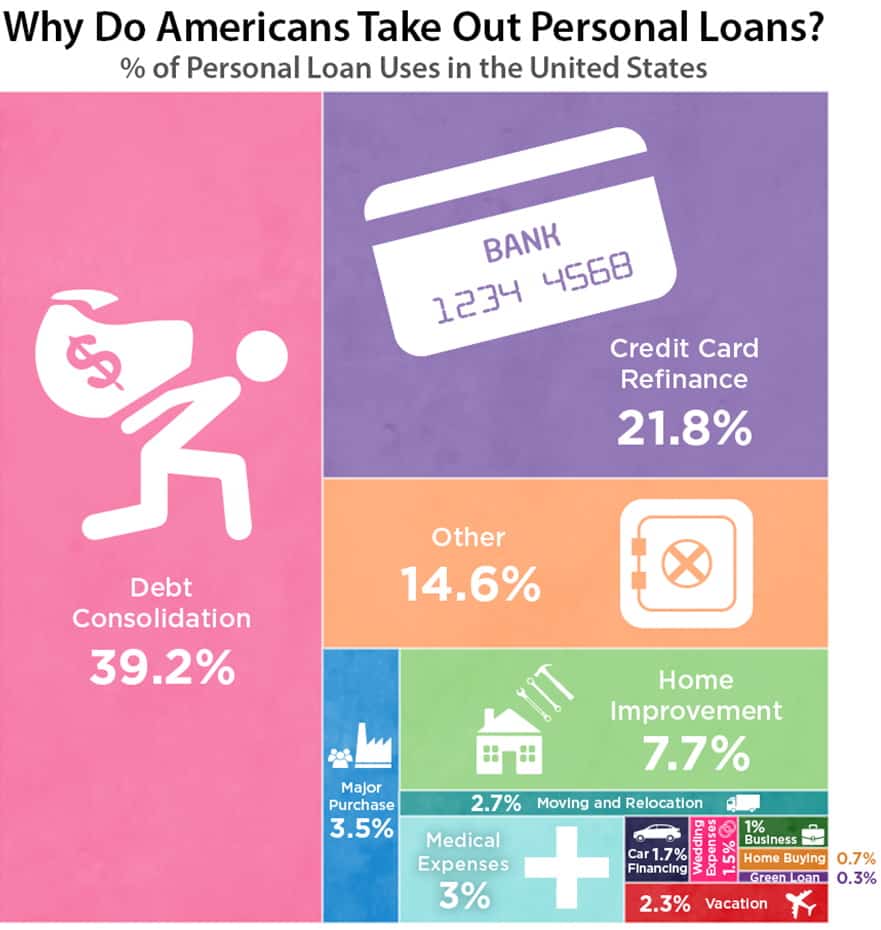

The ratio of taking a loan is dramatically increasing after the pandemic. See the following figure, which elaborates the types of loan taken by Americans.

If you are also considering taking a loan, you have to decide between secured and unsecured loans. The philosophy is simple; in a secured loan, you have to mortgage an asset, and in an unsecured loan, you get the loan directly.

There are different pros and cons of taking these loans. Let’s discuss the difference between secured and unsecured loans in a more elaborative manner.

What is a Secured Loan?

The first type of loan we are discussing is the secured loan. Making it simple for you, an asset guards a secured loan. You can use bonds, stocks, and personal property.

It is not necessary that you have to mortgage a pre-existing asset. You can also use the asset you are going to buy. In this condition, the lender will own the asset until you completely pay the loan.

The basic purpose of mortgaging an asset is that you’ll do whatever it takes to repay the loan. Majority of the population prefer secured loans, as it is convenient to get.

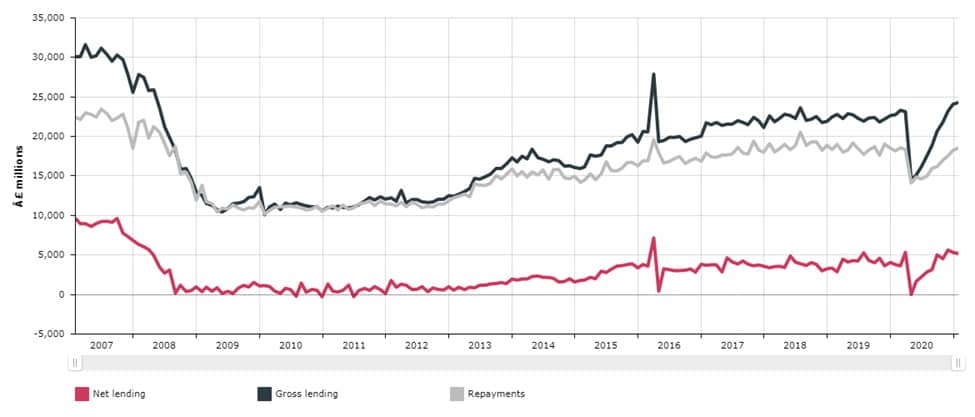

The net worth of the UK secured loan is around £7 billion. The main reason for this is the convenience for the borrower and the opportunity for lenders to recover the amount easily.

See the following illustration reflecting the amount of secured loan approved by the Bank of England.

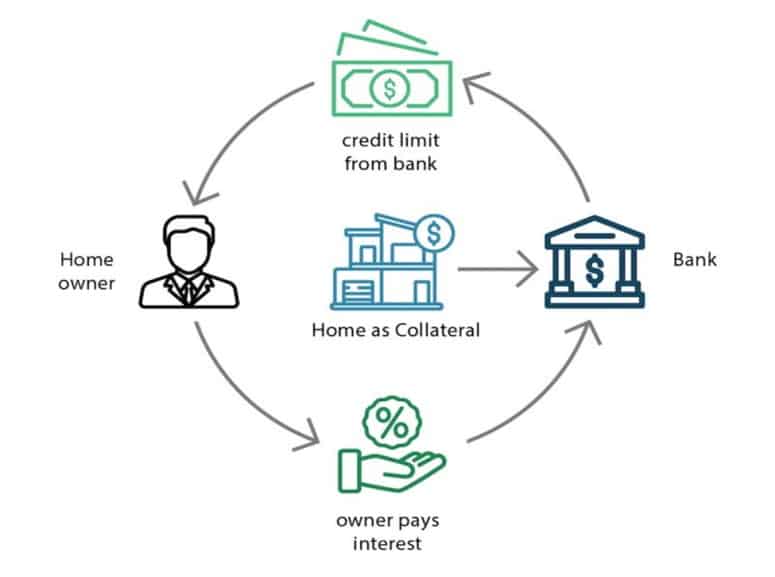

One rule that benefits both entities is that; mortgage asset in a secured loan can be collateral. It means; if an asset is auctioned, you’ll receive the amount that you have already paid in terms of loan installment.

Examples of Secured Loan

The secured loans can be mold and altered based on mutual consequences between the entities. Though, the basic types of a secured loan are;

- Home Equity Line of Credit: In this type of loan, your residential property will be a collateral mortgage.

- Mortgage: It is a loan to purchase a residential property. You’ll have to pay back the loan in installments as per the interest, tax, and amount loaned.

- Auto-Loan: It is generally known as Auto-financing; it can be acquired from an auto dealer, bank or credit union.

- Boat-Loan: It is similar to auto-loan, but it is taken to purchase a boat instead of an automobile.

- Recreational Vehicle Loan: It is taken to pay for a motorhome or heavyweight vehicles.

Advantages and Disadvantages of Secured Loan

Secured loans are considered to be the backbone of the banking sector. These types of loans are the most acquired ones.

A larger segment of the middle-income population is dependent upon these loans to purchase their assets, as the return cycle of these loans is convenient.

The core advantages of acquiring a secured loan are;

- They have a lower interest rate, reducing the additional amount need to be paid.

- Banks provide longer and convenient repayment schedules.

- You can also increase your credit score by repaying loan installments on time.

With the aforementioned advantages, there are some disadvantages of secured loan also;

- In case you fail to repay them, you’ll lose your hard-earned asset.

- It can also create a direct and negative impact on your credit score.

What is an Unsecured Loan?

Unsecured loans are the opposite of secured loans. These loans include; credit card loans, student loans, and personal loans. Around 19.1 million people are currently under debt to pay the unsecured loan.

In this type of loan, the lender takes more risk by providing your finances without any return guarantee or asset. There would be no chance of their recovery if the borrower failed to repay the loan.

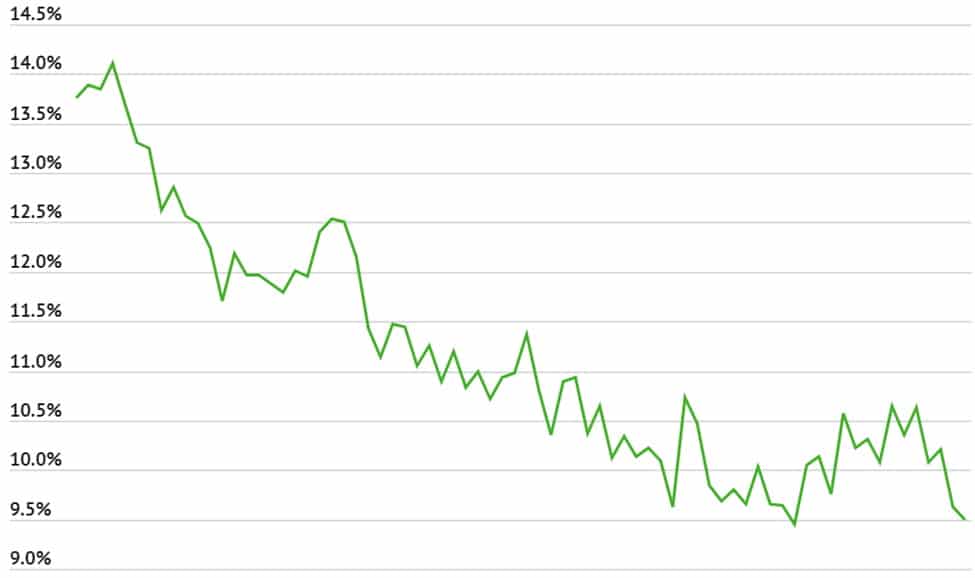

This is why the interest rate in these loans is higher, contrary to a secured loan. The average interest rate is around 10%-28%, but it varies with time. See the following figure to know about the interest rate of unsecured loans;

If you are a defaulter of an unsecured loan, you can still file for a secured loan. But for this, you must have collateral property.

Though, this option is not available if you are a secured loan defaulter. The parameters to gauge the borrower’s ability to repay an unsecured loan are based on five Cs.

- Character: It refers to employment history, references, and credit score.

- Capacity: It only includes current debt and source of income.

- Capital: Investments or monetary deposits.

- Collateral: Personal assets like a car or home.

- Conditions: the postulates of agreement.

Examples of Unsecured Loan

See the following examples of unsecured loans which you can acquire after being filtered from five Cs.

- Personal Loans: These loans are taken for personal use. It can vary from a few hundred to thousands of dollars. Around 49% of people take this loan to consolidate their debt.

- Credit Cards: They can vary as per your account balance. But generally, you can use them for a month and have to pay the bill. In case you didn’t repay the bill, the bank will charge interest on it.

- Student Loan: These are taken to pay the tuition fees of academic institutes. Though, it requires approval from the bank and the Department of Education.

- Personal Line of Credit: they are similar to a credit card. You can sue them up to a limit for purchasing any personal use item.

Advantages and Disadvantages of unsecured Loan

Despite higher interest rate, unsecured loans are preferred by consumers due to their easy acquiring process.

Let’s discuss some of the core advantages of unsecured loans;

- Anyone can acquire this loan, regardless of the assets they owned.

- It poses no risk to your assets.

- Repayment of these loans is in short duration.

Along with these advantages, there are some disadvantages of these loans also.

- They have a very high-interest rate.

- The amount of unsecured loans is limited. It depends on different factors. Generally, banks do not lend more than £ 25,000.

- The terms and conditions of these loans are less flexible.

Taking the Best Financial Decision

The percentage of loan borrowers is rapidly increasing. The core reason is the finical impact pandemic has created on people. In broader terms, the loans can be secured or unsecured. The secured loan refers to the loan in which you have to mortgage a property. The unsecured loan is opposite to the secured loan.

Both the loans have their own perks and benefits. People utilize both sorts of loans. Acquiring these loans is dependent upon the feasibility and financial conditions of the borrower.

If you have assets, then secured loans are best, and if you don’t have, then unsecured loan. Make sure that you have to pay loan installments on time, as it can directly affect your credit score.